philadelphia property tax rate 2022

Reporter Philadelphia Business Journal. For questions about your account email revenuephilagov or call 215 686-6442.

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

. The median property tax on a 13520000 house is 141960 in the United States. Ultimate Philadelphia Real Property Tax Guide for 2022. Philadelphia Property Taxes Range.

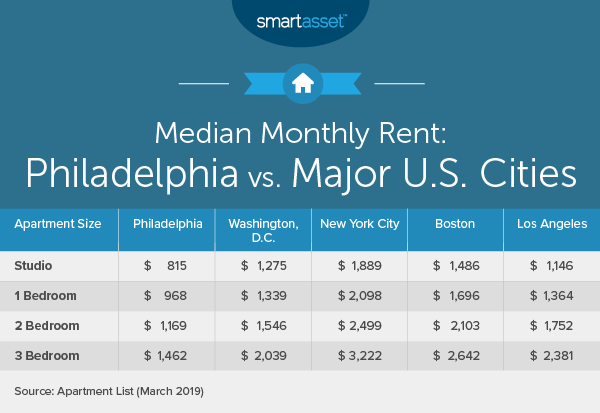

Yearly median tax in Philadelphia County. Residents making 100 an hour have the same 38398 wage tax rate as those making the 725 minimum wage. Average Property Tax Rate in Philadelphia.

While the citys property tax rate has not changed in the last few years some property owners have had significant tax increases due to changing assessments. Only property owners whose values change will receive notifications. The City of Philadelphia will skip property tax reassessments for the 2022 tax year due to Covid-19 operational issues.

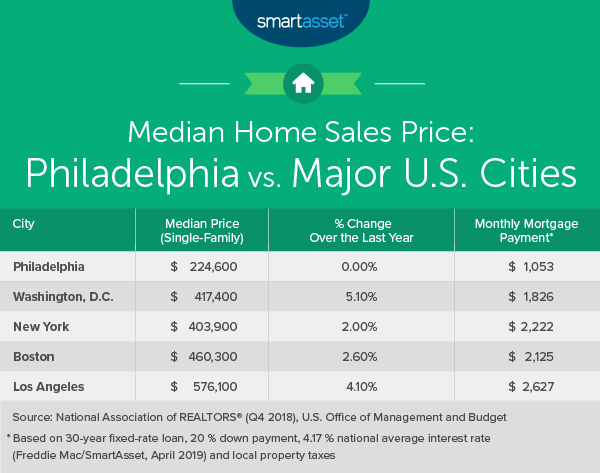

Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts. An office building worth 50 million has the same 13998 property tax rate as a home worth 50000. Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022.

Ultimate Philadelphia Real Property Tax Guide for 2022. Pennsylvania is ranked 1120th of the 3143 counties in the United States. But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan.

March 15 2022 at 925 am. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. All other design information text graphics images pages interfaces links software and other items and materials contained in or displayed on this site and the selection and arrangements thereof are the property of the City of Philadelphia.

Legal Services Nonprofits Help Those Struggling Keep Homes. Based on latest data from the US Census Bureau. The proposed tax rate for fiscal year 2022 is 1489.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow. 32640 Room board.

If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Find more information about Philadelphia Real Estate Tax including information about discount and assistance programs. By Kennedy Rose.

Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make. Ad Research Is the First Step to Lowering Your Property Taxes. 80 million in 2020 Tuition 2022-23.

CBS New Jersey homeowners could get a break on the countrys highest property taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Holy Family University 39k 9801 Frankford Ave.

For the 2022 tax year the rates are. 7990 On financial aid. The median property tax on a 13520000 house is 182520 in Pennsylvania.

The median property tax on a 13520000 house is 123032 in Philadelphia County. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Please use this website for the current Real Estate Tax balances due on. In this image provided by the Chronicle of Philanthropy Elizabeth Vermillera sits on the front porch. 091 of home value.

A bill that took effect Jan. Gov Phil Murphy wants to give homeowners earning up to 250000 a year an average rebate. Just call 215 686-6442 and ask about our Real Estate Tax relief.

Browse Current and Historical Documents Including County Property Assessments Taxes. 1 shrinks the value of the 10-year abatement for new residential properties by 10 annually starting after the first year until. Help is also available to veterans.

Philadelphia could see a short spike in construction in 2022 after a record number of developers applied for permits ahead of the citys expiring property tax abatement. Reading this guide youll obtain a good insight into real property taxes in Philadelphia and what you should take into. Those property owners will receive notice of their assessments by March 31 and their new values will take effect for taxes in 2022.

Different rates for various types of property though commonplace elsewhere are prohibited. The fiscal year 2021 rate was also 1489 The city expects to get 1860518 in revenue from the tax levy which is a 414 increase from the. Tax Year 2022 assessments will be certified by OPA by March 31 2021.

Philadelphia Property Taxes Range. You can also generate address listings near a property or within an area of interest. Philadelphia PA 19105.

Enter Your Address to Begin.

The Cost Of Living In Philadelphia Smartasset

Philly Real Estate Analyst S Predictions For 2022 Whyy

Philadelphia County Pa Property Tax Search And Records Propertyshark

Pin On 5 The Philadelphia Editor 2018 Edition

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

1414 S Penn Sq Unit 25cde Philadelphia Pa 19102 Realtor Com

20 Honest Pros Cons Of Living In Philadelphia The Helpful Local

Does Philadelphia Tax Retirement Income Tax Exemption

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

The Cost Of Living In Philadelphia Smartasset

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

Philadelphia County Pa Property Tax Search And Records Propertyshark