milwaukee county wi sales tax rate

Foreclosed Properties for Sale. The 2018 United States Supreme Court decision in South Dakota v.

Sales Taxes In The United States Wikiwand

If you need access to a database of all Wisconsin local sales tax rates visit the sales tax data page.

. The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin. Wisconsin has 816 cities counties and special districts that collect a local sales tax in addition to the Wisconsin state sales taxClick any locality for a full breakdown of local property taxes or visit our Wisconsin sales tax calculator to lookup local rates by zip code.

Milwaukee County Treasurers Office 901 N. To review the rules in Wisconsin visit our state-by-state guide. The December 2020 total.

Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. For parcels with bankruptcy filings please call our office at 414-278-4033 before making payments.

Wisconsin has state. Milwaukee County Property Records are real estate documents that contain information related to real property in Milwaukee County Wisconsin. 150000 3 Bd 25 Ba 1566 Sqft 96Sqft.

4 rows The current total local sales tax rate in Milwaukee WI is 5500. These buyers bid for an interest rate on the taxes owed and the right to. What is the sales tax rate.

These records can include Milwaukee County property tax assessments and assessment challenges appraisals and income taxes. The current Milwaukee County sales tax rate is 56 percent. The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax.

Verification and processing of claims takes four to eight weeks. Unpaid real estate taxes from 2018 and prior are eligible for tax foreclosure. The Wisconsin state sales tax rate is currently.

Milwaukee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Milwaukee County Wisconsin. The Treasurers office will contact the claimants to inform them when their claim is completed. Has impacted many state nexus laws and sales tax collection requirements.

Milwaukee County WI currently has 3329 tax liens available as of April 18. 3 rows Milwaukee County. Milwaukee Health Department Coronavirus COVID-19 updates.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Milwaukee County WI at tax lien auctions or online distressed asset sales. Multi Unit Business For Sale - 1100000. The program is open to individuals and families who live in Wisconsin with overdue housing-related bills both with and without a mortgage who meet income and other eligibility.

Average Sales Tax With Local. 3821 N 23rd St Milwaukee WI 53206. WI Sales Tax Rate.

The Milwaukee County sales tax rate is. The stadium sales tax of one-tenth of a percent is set to be rolled back in 2020. Brownberry Bread Route distributorship for sale in the Oak Creek Wisconsin region.

A county-wide sales tax rate of 05 is. For assistance please call the MHD COVID Hotline 414-286-6800. Brownberry Bread Route Oak Creek WI.

The Milwaukee County Sales Tax is 05. Milwaukee County Web Portal. 385000 4 Bd 25 Ba 2384 Sqft 161Sqft.

Checks will be mailed to the address provided by the claimant in the unclaimed funds request form. 6 rows The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state. This business is considered essential and recession resilient highly profitable.

Milwaukee County is home to over 950000 people living in one of 19 communities which range in size from the City of Milwaukee with 595000 residents to the Village of River Hills with roughly 1600 residents. 2335 W Suelane Rd Glendale WI 53209. The current total local sales tax rate in Milwaukee.

9th St Room 102 Milwaukee WI 53233-1462. We do not collect Personal Property Taxes contact your City or Village for these. Wisconsin Help for Homeowners Wisconsin Help for Homeowners WHH is a new statewide program that can help with overdue bills like mortgage payments property taxes utilities and more.

Sales Taxes In The United States Wikiwand

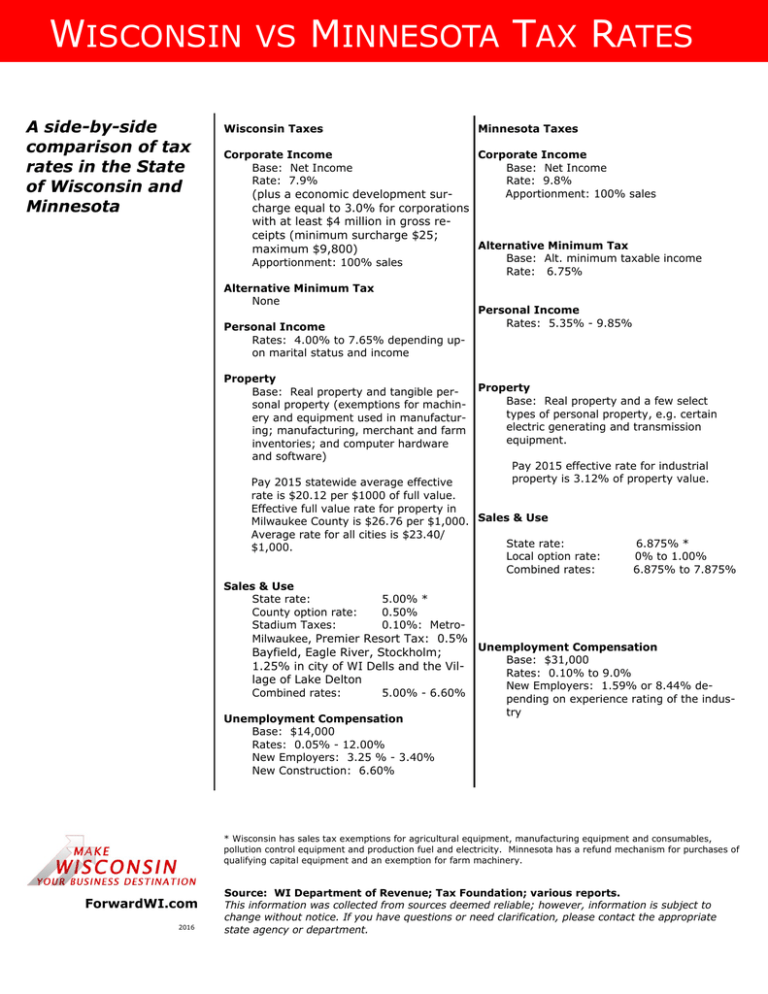

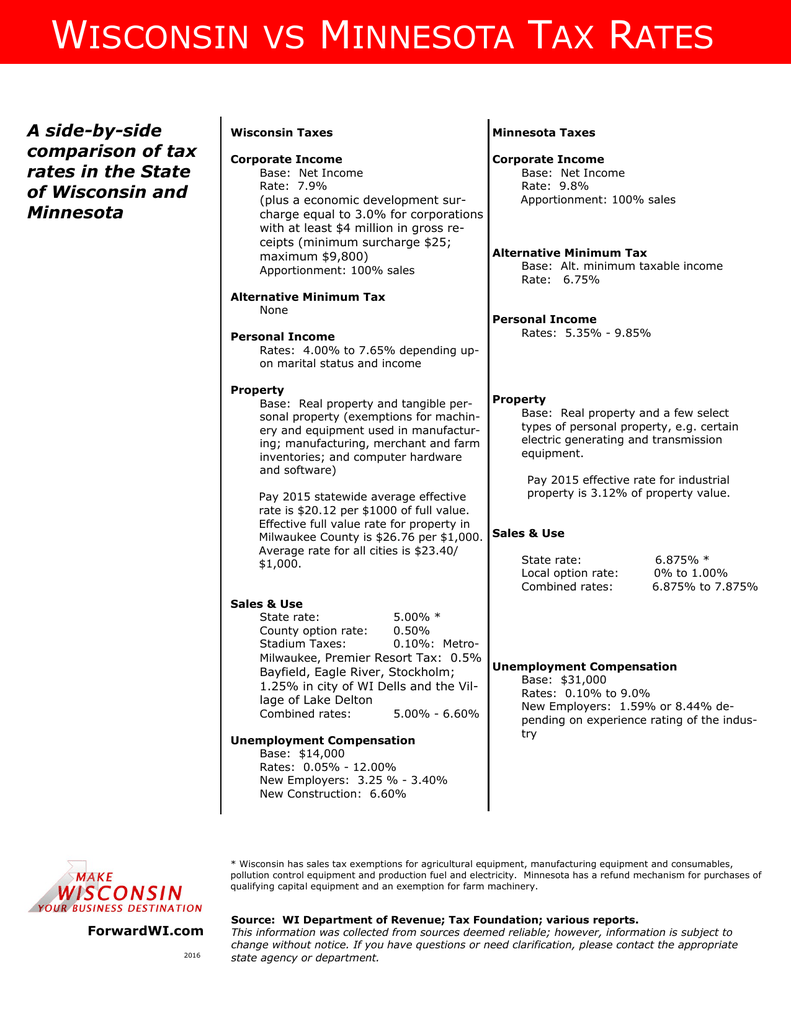

Wisconsin Vs Minnesota Tax Rates

North Central Illinois Economic Development Corporation Property Taxes

Milwaukee Leaders Warn Of Dire Future Without Shared Revenue Sales Tax Increase Wisconsin Public Radio

Wisconsin Property Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Report In The Last 40 Years Wisconsin S Income Tax Has Become Less Progressive Wisconsin Public Radio

Form St 12 Sales And Use Tax Return 10 07 Schedule Ct Fill In Form 04 10 Instructions 07 13 Find Wisconsin State County And Stadium Sales Tax Rate My Tax Account E Filing

Sales Taxes In The United States Wikiwand

Wisconsin Sales Tax Small Business Guide Truic

Form St 12 Sales And Use Tax Return 10 07 Schedule Ct Fill In Form 04 10 Instructions 07 13 Find Wisconsin State County And Stadium Sales Tax Rate My Tax Account E Filing

Wisconsin Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand